Calculate medicare tax 2023

TaxCalc has now been updated following the 2022 Federal Budget. Tax and salary calculator for the 2022-2023 financial year.

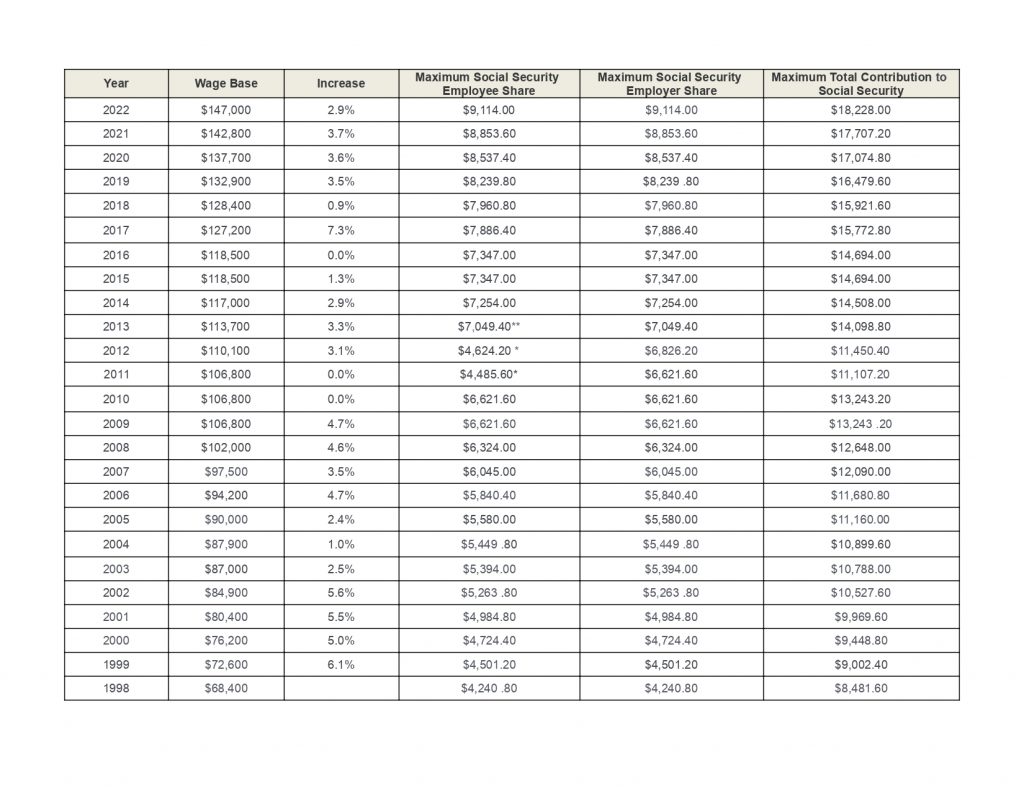

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Self-Employed defined as a return with a Schedule CC-EZ tax form.

. Resident tax rates 202021. For CY 2022 we are finalizing a policy to exempt procedures that are removed from the inpatient only IPO list under the OPPS beginning on or after January 1 2022 from site-of-service claim denials. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

The Medicare levy surcharge is an additional tax of between 1 and 15 depending on how much you earn. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your personal tax questions. Before sharing sensitive information make sure youre on a federal government site.

Calculate your tax and after tax salary Enter your taxable income in dollars. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. 1 online tax filing solution for self-employed.

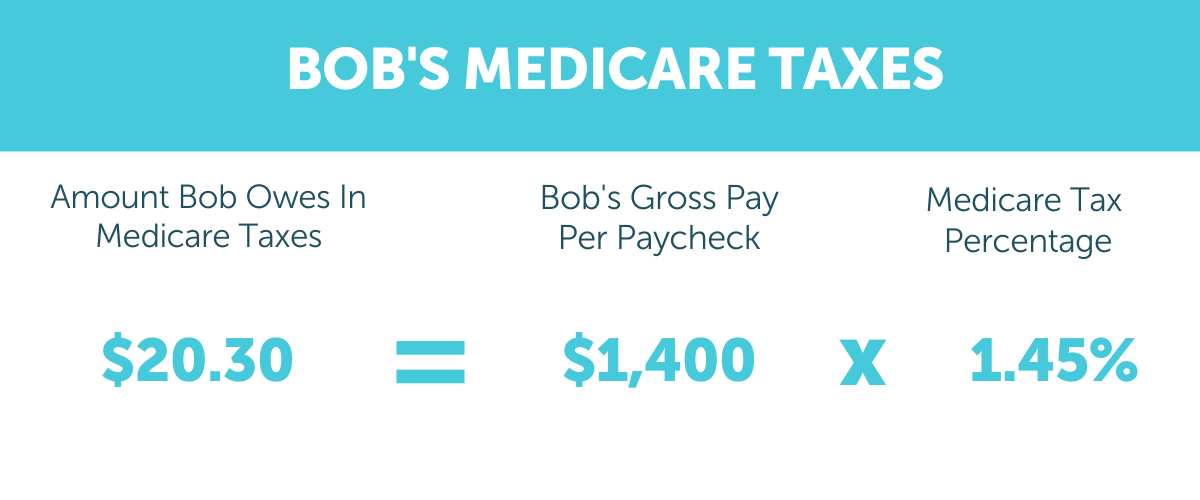

Medicare taxes apply only to your earned income not your property or inheritance income. SOCIAL security benefits for Americans are predicted to rise by 159 in 2023 according to the most recent CPI-W statisticsWhen seasonally adjusted. 19 cents for each 1 over 18200.

Welcome to TaxCalc the Australian income tax calculator. Federal government websites often end in gov or mil. Also calculates your low income tax offset HELP SAPTO and medicare levy.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. The latest State tax rates for 202223 tax year and will be update to the 20232024 State Tax Tables once fully. So make sure to file your 2019 Tax Return as soon as possible.

Please enter your salary into the Annual Salary field and click Calculate. 6 to 30 characters long. Meaning an employer and an employee both contribute.

Income tax Medicare and allowances tax tables for 2023 as used on the Australia Tax Calculator on iCalculator. You also need to pay into the system by the Federal Insurance Contributions Act tax up to a maximum taxable earnings level to. Under these provisions certain employers called applicable large employers or ALEs must either offer health coverage that is affordable and that provides minimum value to their full-time employees and offer coverage to the full-time.

202223 Nebraska State Tax Refund Calculator. Taxable income Tax on this income. Tax rates vary depending on residential status.

The full 15 is only applied to singles who earn more than 140k a year or couples. The FICA portion funds Social Security which provides benefits for retirees the disabled and children of deceased workers. With the help of the above Australian tax calculator you can calculate tax for the years 2022-2023.

We have zero data point as of right now for what the IRMAA brackets will be in 2024 based on 2022 income. The above rates do not include the Medicare levy of 2. If the amount of your total medical and dental deductions is greater than 75 of your gross income you can deduct premiums for your Medicare Part A if applicable Part B Part D Medicare Advantage or Medicare Supplement plan as well.

Medical Review of Certain Inpatient Hospital Admissions under Medicare Part A for CY 2021 and Subsequent Years 2-Midnight Rule. The 2023 tax calculator is designed to provide quick income tax calculations and salary examples. For salary and wage payments made on or after 1 July 2022 the new superannuation guarantee contribution rate of 105 will apply.

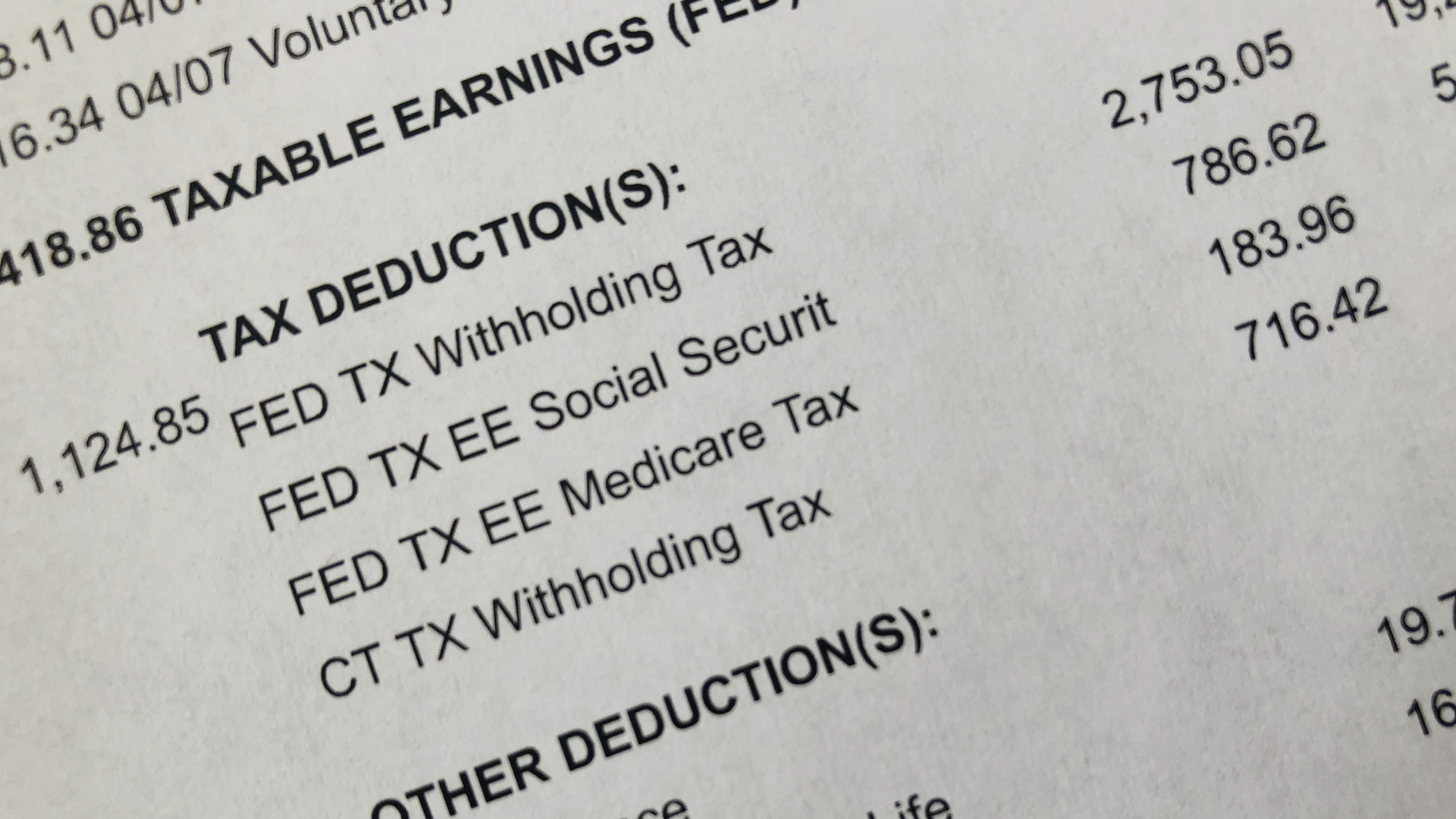

Calculate your tax and after tax salary Enter your taxable income in dollars. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. Report a negative adjustment on Form 941 line 9 Form 944 line 6 for the uncollected social security and Medicare taxes.

Individuals on incomes below 18200 are also entitled to the Low and Middle Income Tax Offset LMITO. After July 15 2023 you will no longer be able to claim your 2019 Tax Refund through your Tax Return. Dont include any uncollected Additional Medicare Tax in box 12 of Form W-2.

Also calculates your low income tax offset HELP SAPTO and medicare levy. What you can do to meet the performance requirement. Medicare is a government national health insurance program.

Enter the amount of uncollected social security tax and Medicare tax in box 12 of Form W-2 with codes A and B respectively. The amount is subject to change at any time. Terms and conditions may vary and are subject to change without notice.

In addition to income tax there are additional levies such as Medicare. So check your payslip employer is paying you the correct amount of super. If you own more than one business you can only use one business to calculate your premium tax deduction.

Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first 7000 of each. But if youre self-employed youll be responsible for the full. The Congressional Research Service projects Medicare Part B.

This calculator is for the 2022 tax year due April 17 2023. You are not allowed to combine the income from all your businesses. The IRS will determine the Medicare tax rate for 2023.

Overview of key changes. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. 2023 IRMAA Brackets.

Tax Return Access. Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. Americas 1 tax preparation provider.

How we calculate your lodgment performance. The employer shared responsibility provisions were added under section 4980H of the Internal Revenue Code by the Affordable Care Act. The gov means its official.

Must contain at least 4 different symbols. They usually do that in October or November. To deduct your self-employment Medicare.

You can calculate salary examples and tax commitments for each of those tax years using the advanced feature on the Australia Tax. The 2023 premium is expected to stay flat or go down slightly compared to 2022. Self-employed individuals must calculate the entire 29 tax on self-employed net earnings because they are both employee and employer but they may deduct half of the tax.

Medicare also hasnt announced the 2023 standard Part B premium yet. ASCII characters only characters found on a standard US keyboard. Medicare taxes are payroll tax.

Medicare and private health insurance. To be clear Medicare premium tax deductions dont only apply to Original Medicare. Click Calculate to see your tax medicare and take home breakdown - Federal Tax made Simple.

And adds hearing services subject to Medicare Part B deductible and 20 coinsurance beginning in 2023. Updated with 2022-2023 ATO Tax rates.

Payroll Tax Vs Income Tax What S The Difference

What Is The Fica Tax And How Does It Connect To Social Security Gobankingrates

Will Selling My Home Affect My Medicare Clearmatch Medicare

Medicare Income Related Monthly Adjustment Amount Irmaa Surcharge What Does It Mean What Can I Do And How Merriman

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Easiest 2021 Fica Tax Calculator

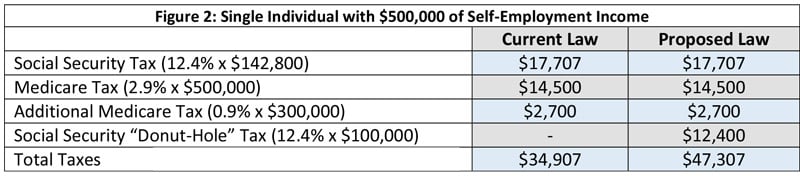

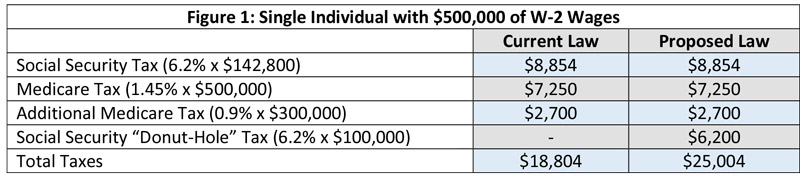

Biden S Payroll Tax Hike Plan Beyond The Donut Hole Thinkadvisor

How The Medicare Tax Rate Is Changing Medicarefaq

Social Security Payroll Tax Here S How Much The Average American Will Owe In 2018 The Motley Fool

How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self Employed Youtube

Medicare Part B Premiums For 2022 Jump By 14 5 From This Year Far Above The Estimated Rise In Cost Medicare Required Minimum Distribution Tax Brackets

Biden S Payroll Tax Hike Plan Beyond The Donut Hole Thinkadvisor

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self Employed Youtube

Are Medicare Premiums Tax Deductible In 2021 Medicarefaq